Personal Loans: A Flexible and Accessible Financial Solution

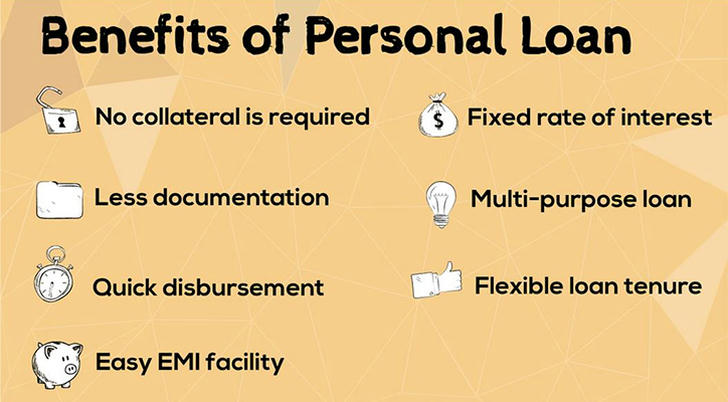

In today’s world, unexpected expenses can arise at any time—whether it’s medical bills, home repairs, or education costs. Personal loans provide an easy way to meet these needs, especially for people with less-than-perfect credit. This loan product offers several advantages, including low interest rates, no impact on your credit score, and a quick, simple application process.

Loan Options for Every Credit Score

Unlike many traditional loans that rely heavily on your credit score, this loan product is available to everyone—regardless of credit history. The lender looks at your overall financial situation, rather than just focusing on your score, making it more accessible for those who might have had financial setbacks in the past.

Low Interest Rates, Less Financial Burden

With interest rates starting as low as 9.90%, this loan offers a significantly more affordable option than many traditional loans. Lower rates mean you’ll pay less interest over the life of the loan, making it easier to manage your finances and stay on top of payments.

Rebuild Your Credit with No Impact on Your Score

Many people avoid taking out loans because they worry about the impact on their credit score. This loan product is designed to help, not hurt, your credit. Timely payments can actually improve your credit score over time, giving you the opportunity to rebuild your financial standing without the risk of further damage to your score.

Flexible Loan Amounts Up to $50,000

This loan allows for flexible borrowing amounts, with loans available up to $50,000. Whether you need funds for home improvements, consolidating debt, or covering unexpected expenses, this loan offers the flexibility to meet a variety of needs.

Example:

Imagine a family needing to upgrade their HVAC system or remodel their kitchen. Instead of waiting or using savings, this loan allows them to cover the cost immediately with affordable monthly payments. Whether it's a small or large project, the loan amount can be tailored to fit their needs.

No Income Verification Needed

One of the biggest hurdles for many borrowers is the requirement for income verification, especially for freelancers, gig workers, or those with irregular incomes. This loan product eliminates that step, making it easier for people in all types of employment situations to apply and qualify.

Simple Application Process, Fast Approval

Applying for a personal loan has never been easier. You can apply online, through mobile apps, or in person, with most approvals happening within 24-48 hours. Many well-known platforms like SoFi, LendingClub, and Prosper offer user-friendly applications. Traditional banks and credit unions may also offer loans, but the process can be slower and more complicated.

Conclusion

This personal loan is a great option for anyone looking for a flexible, affordable way to meet their financial needs. With low interest rates, the ability to borrow up to $50,000, and no need for income verification, it’s accessible to a wide range of borrowers. Plus, it gives you the chance to rebuild your credit without affecting your score.

If you’re looking for a simple, straightforward loan to help you cover unexpected costs, make a large purchase, or consolidate debt, this product could be the solution you need.